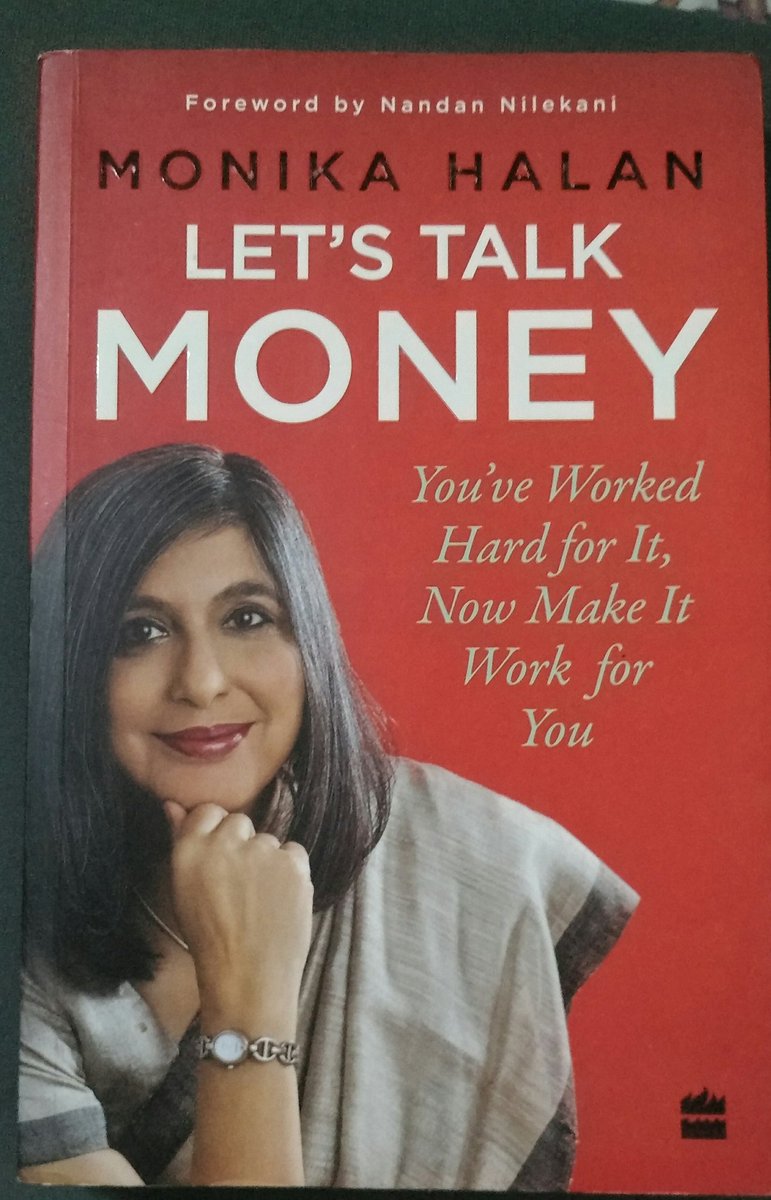

Lets talk money

"Our money worries usually center around finding the best return on investment. But there is a lot more to Financial fitness than just investments. We need a system and not a single-shot solution. "

We worry about the investment the way we worry about our weight. Instead of dieting or investing being a habit, we only think of them as remedial measures when our weight or our bank balance goes too high or low.

Everybody has money to save - from the poor to rich, we just don't know how to look for it. #savings #investing

When you lend money for a non-emergency situation to a person, you lose money, you lose respect for the other person, and somewhere for yourself for getting into a situation like this.

Keeping money ready for an emergency is important. Not only do you not have to worry about the money when you need it, but it also frees up money for long-term investments.

You don't want to discover you have the wrong policy when you reach the hospital. Difficult to negotiate, buying a medical cover is crucial to the health of your money box.

Getting a good medical cover is more important than buying life insurance.

Getting a good medical cover is more important than buying life insurance.

We buy life insurance for all the wrong reasons - fear, greed, pity, frustration, taxes. The real reason for a life cover, to protect your family if you die, is never explained.

The day you realise that it is in your best interest to separate your investment and insurance products, is the day you move solidly towards building your financial security.

The job of the life insurance cover is to serve you till you are debt-free and financially independent.

To protect your family against your untimely death, the only life insurance product you need is a pure term cover.

Do not mix investments and insurance in the same product.

To protect your family against your untimely death, the only life insurance product you need is a pure term cover.

Do not mix investments and insurance in the same product.

We resist investing for many reasons, No money, concerns about safety, not knowing where to invest are just some of the excuses we make.

Not beginning the process of investing because you don't have a large corpus in the first place is like waiting to get fit before you join a diet and fitness routine.

We don't need a lot of money first to start investing. We need a lot of little money streams to keep gathering to make a large corpus.

It is important to start rather than wait for that golden moment when you have a big amount to hit the market with.

It is important to start rather than wait for that golden moment when you have a big amount to hit the market with.

Setting up of emergency fund and buying insurance covers are ways to protect our money box from unavoidable events as you journey through life, and to reduce the damage to your Finances they bring.

A big reason why people stay in fixed deposits, gold, insurance, and real estate is the fear of making errors.

Sugar-filled food is fine for a person who is healthy but poisonous for a diabetic. Salt is fine for most people, but gun powder for hypertension people. Financial products are similar, not everything suits everybody - we need to match our financial needs to financial products.

A product that is very safe in the long run becomes very risky in the short term.

It is never the "right" time to begin investing.

It is always good to be nice to the person who holds something sharp near your neck.

Basic finance is not tough to understand, choosing a product is.

There is a purpose you buy, and each product needs to fight with others to grab that place in your box.

There is a purpose you buy, and each product needs to fight with others to grab that place in your box.

Gold does not give an interest like a deposit. It does not give dividends like a stock. Nor does it give rent, like property. The only profit from gold is when its value goes up - when you actually make a profit, which depends on when you bought it and how long you held it.

The most misunderstood of all asset classes, stocks are not a lottery. where some people get lucky. There is math and science and a way to take risks safely.

Equity is a slow cook and not instant noodles.

What we need to understand is that when we talk about investing in equity, we are not talking about gambling on the street.

What we need to understand is that when we talk about investing in equity, we are not talking about gambling on the street.

We use an index number all the time and that is the inflation index.

If you could just buy the Sensex or Nifty50, you would hold automatically the large, bestselling companies in India that represent the sectors of the economy that are doing well.

If you could just buy the Sensex or Nifty50, you would hold automatically the large, bestselling companies in India that represent the sectors of the economy that are doing well.

Just as the food index will be more volatile than a broader consumer price index, so also the Sensex will be more stable than the changes in a midcap index or a sector index.

Volatility affects those who deal in the stock market for short periods of time, but the longer you allow an index to work, the lower the effect of volatility

Rising prices, over the long term, reflect the growth and profits of a company.

Stocks are the best route to get inflation-adjusted returns. As inflation rises in the system - the input costs for the firms go up - they are passed on to the consumers in the form of final prices.

Stocks are the best route to get inflation-adjusted returns. As inflation rises in the system - the input costs for the firms go up - they are passed on to the consumers in the form of final prices.

It is not market timing but time in the market that matters.

Time in the market matters because it smoothens out the volatility of the market.

Nine out of ten say real estate gives the highest return and the tenth gold as the best investment.

Time in the market matters because it smoothens out the volatility of the market.

Nine out of ten say real estate gives the highest return and the tenth gold as the best investment.

Rules of equity investing

1. When investing in the stock market, give it the same patience you give in real estate.

2. Your risk is choosing poor products and finding out after fifteen years that your fund manager has malfunctioned.

1. When investing in the stock market, give it the same patience you give in real estate.

2. Your risk is choosing poor products and finding out after fifteen years that your fund manager has malfunctioned.

3. If you find yourself frozen while choosing equity products in the market, go with Exchange Traded Fund or an index fund.

4. Do not invest in any product that locks you into a particular company or asset manager.

5. If you want to invest in managed funds, start learning.

4. Do not invest in any product that locks you into a particular company or asset manager.

5. If you want to invest in managed funds, start learning.

There is no money box without a mutual fund. There is a product for every situation and regulation that puts your interest first.

You can build your entire portfolio by buying mutual funds across these asset classes.

We reduce our risk by increasing the number of products we hold.

You can build your entire portfolio by buying mutual funds across these asset classes.

We reduce our risk by increasing the number of products we hold.

We need to understand a bit more about how funds are classified before we can invest in them.

Expecting a long-term debt fund to give you returns in the short-run is like expecting an airplane to take you to the local market.

Expecting a long-term debt fund to give you returns in the short-run is like expecting an airplane to take you to the local market.

We need a short-term product for short-term needs. We need medium-term products for medium-term needs. We need long-term products for long-term needs.

The role of gold in the money box is to provide diversification and a hedge against inflation.

The role of gold in the money box is to provide diversification and a hedge against inflation.

Small and midcap stocks are the engines of growth in a portfolio.

Think of an open-ended fund as like a very long unending escalator and a close-end fund like a lift.

If you understand NAV, expense ratio, you will know why the NAV of direct will become higher than that of regular.

Think of an open-ended fund as like a very long unending escalator and a close-end fund like a lift.

If you understand NAV, expense ratio, you will know why the NAV of direct will become higher than that of regular.

Using the vehicle of a SIP is good for two big reasons.

1. We usually earn a fixed amount each month and have a monthly surplus left over after expenses.

2. SIP allows you to average out your price as you invest over the year.

But remember SIP is a vehicle and not the goal.

1. We usually earn a fixed amount each month and have a monthly surplus left over after expenses.

2. SIP allows you to average out your price as you invest over the year.

But remember SIP is a vehicle and not the goal.

You don't just buy the product because it is sold to you. Each product in your money box needs to justify its space.

A financial product is invisible and is created when the person selling it, describes it, or when it is described in a brochure or website.

A financial product is invisible and is created when the person selling it, describes it, or when it is described in a brochure or website.

The seller will talk up all kinds of features, but at the very basic level, an investment-oriented financial product must be evaluated on six parameters.

Cost

Return

Lock-in

Cost to exit early

Holding period

Taxes.

Cost

Return

Lock-in

Cost to exit early

Holding period

Taxes.

Finance is not just about numbers, it should work for all the people in the house and must look after individual preferences, fears, and goals.

Choosing products is by far the most difficult part of a financial plan.

You need to target 18 to 35 times your annual spending at sixty for your retirement.

You are financially free when you don't need to work to pay your bills. You have enough assets that generate through enough income today and for the rest of your life.

The idea of financial freedom is to be free of any strings. Either from a boss or from your kids when you are old.

Inflation is relentless and even when the rate of inflation falls it does not mean that prices go down. They just rise more slowly.

How to get the money.

Comments

Post a Comment